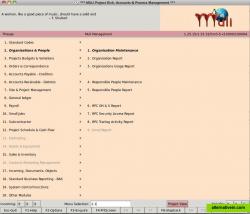

muli is an integrated solution for contractual risk, equipment costing, materials inventory, project risk analysis, job costing, payroll, estimating and scheduling for the building and construction industries.

managing projects with generic accounting/spreadsheets means high flexibility but inherently, lower accuracy.

muli is the opposite, we enable growing construction companies to leverage our 33 year experience, built into the software's 'stopsandchecks' framework.

integrated functionality includes;

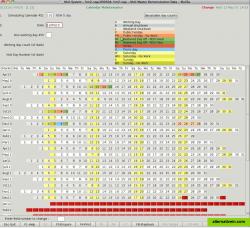

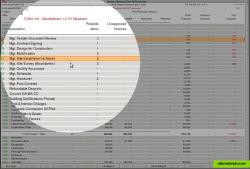

subcontractor management project management (project review cost & process) project budgets & variations 'one click', 'real time' overview of project and company profitability and liquidity orders, contract correspondence accounts payable/receivable (head contract summary cost plus lump sum) project risk2do & job opportunities small jobs full 'project' payroll system (available as an addon) with 'one click' reporting and ato uplink.

http://www.muli.com.au/muli101 (general introduction video)

muli's approach to construction accounting;

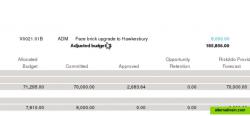

muli systematically tracks 'income' and 'expensestocompletion' to forecast a project's gross margin.we then calculate what percentage of a project is complete, as work 'approved' over 'final forecast' invoices. each project thus contributes ongoing "earned value" to the company ('gross margin' x 'percentage complete'). generic accounting/spreadsheets fall short on accuracy in this area.

muli believes only once all project contributions exceed company expenses, does that company make a profit.muli's process' ensure risk elements are properly verified, thus projects are accurately reporting earned valuemuli clearly defines 'prepayment liquidity' from true, earned value profitability over longterm/multi stage construction projectsmuli's reports clearly review your contracts which are sustainable in risk and liquidity terms

6 Like

6 Like 1 Like

1 Like